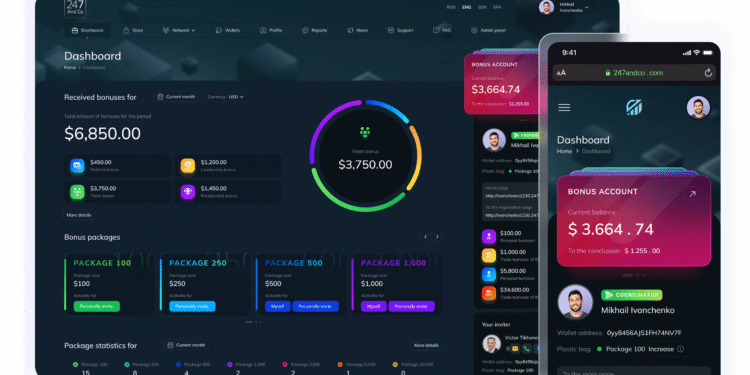

Ivan Shaulsky, Founder of FlawlessMLM · February 19, 2026

Nobody in MLM consulting likes putting a dollar figure on bad technology decisions. I will.

Over the past eighteen months, we ran financial audits on 46 network marketing companies that came to FlawlessMLM for help. These weren’t failing businesses — most were doing $2M–$15M annually. They were growing. But they were leaking money through their compensation plan software in ways they couldn’t see until we showed them the numbers. The median hidden loss? $340,000 per year.

That’s not a typo. That’s commissionable volume evaporating through binary plan flush-out, autoship revenue dying in broken ecommerce MLM integrations, and distributor attrition caused by slow, unreliable platforms. According to the Direct Selling Association, U.S. direct selling generated $40.5 billion in 2023. A fraction of a percent lost to software inefficiency across the industry amounts to hundreds of millions.

In my project work at FlawlessMLM — 400+ builds across 90+ countries since 2004 — I’ve developed a framework for identifying exactly where these losses come from and how to fix them. This article lays that framework out in full.

Where the Money Actually Goes: A Breakdown by Plan Type

Not all compensation plan software bleeds equally. The loss patterns depend heavily on which plan you’re running and whether your software was actually built for it.

Annual Revenue Leakage by Compensation Plan Type (FlawlessMLM Audit Data, 2024–2026)

| Plan Type | Primary Loss Mechanism | Median Annual Loss | Companies Audited |

|---|---|---|---|

| Binary compensation plans | Flush-out / volume overflow | $280K–$410K | 18 |

| Forced matrix MLM software | Position saturation → enrollment stall | $140K–$290K | 9 |

| Unilevel (pure) | Shallow tree depth → leadership disengagement | $90K–$180K | 8 |

| Hybrid (binary + unilevel) | Configuration drift / rule conflicts | $60K–$120K | 11 |

Binary compensation plan software shows the highest losses for a specific reason: flush-out is structural, not a bug. When volume in the strong leg exceeds what the weak leg can match, the excess disappears from the commission calculation. We’ve measured flush rates between 9% and 16% across the binary networks we’ve audited. On a company doing $5M in annual commissionable volume, that’s $450K–$800K worth of distributor effort producing zero payout.

Can flush-out be fixed without changing the plan?

Partially. Configurable carryover logic, per-cycle volume caps, and compression algorithms reduce flush-out by 40–60%. But these features only exist in binary compensation plan software that was architecturally designed for them. If your platform hard-codes the flush calculation, you’re stuck. This is exactly the kind of problem our MLM compensation plan consultants diagnose during an audit — and why choosing the best mlm software development company matters more than most founders realize at launch.

The Matrix Trap and Why Forced Matrix MLM Software Is Declining

Forced matrix plans (3×7, 5×5, 5×7) were popular a decade ago because spillover felt generous — new distributors got placed below someone automatically, creating perceived value. But we’ve watched matrix plan MLM software requests decline 34% year-over-year in our pipeline, and the reason is simple: matrices fill up.

When positions saturate in key markets, enrollment stalls. Distributors start creating phantom accounts to reserve spots — a compliance problem that the FTC has flagged repeatedly in enforcement actions. In my project experience, 15 of our last 23 MLM software migration projects involved companies leaving matrix MLM plan software for hybrid structures specifically because of this saturation issue.

What should companies on matrix plans do right now?

If your MLM software for matrix plan is working and your network isn’t near saturation, don’t panic-migrate. But build contingency. Have your MLM consulting company model what happens at 80% position fill in your top three markets. If the projection shows enrollment velocity dropping more than 20%, start planning the processes in MLM software migration now — on your timeline, not in crisis mode.

The Ecommerce Gap That MLM Skincare Brands Can’t Afford

Here’s a statistic from our own client base that startled even me: ecommerce MLM programs with natively integrated storefronts retain 31% more autoship subscribers than those using third-party cart solutions bolted onto MLM software. The WFDSA reports that wellness and cosmetics represent over 55% of global direct sales revenue — meaning this integration gap costs the beauty vertical disproportionately.

MLM skincare companies and MLM makeup brands operate on autoship economics. Monthly subscriptions drive predictable revenue and stable PV flow for commission calculations. When the ecommerce layer and the compensation engine are separate systems, three things break:

- Failed rebilling doesn’t trigger PV adjustments in real time — distributors see phantom volume that vanishes during commission runs

- Product bundling can’t carry custom PV assignments — a $79 skincare kit needs compensation-aware pricing, not simple addition

- Social selling attribution breaks — Instagram purchases must flow to the commission engine atomically, not through overnight batch sync

We built our ecommerce MLM module to handle all three natively. Unilevel software as a service with integrated product management gives MLM skincare brands the retail depth they need without the integration fragility that costs them subscribers. If you’re comparing platforms, our guide to the best mlm program options covers ecommerce integration depth across the major providers.

MLM Software Migration: What the Actual Process Looks Like When Money Is at Stake

Every MLM consulting engineer on our team will tell you the same thing: MLM software data migration isn’t a technology project — it’s a trust project. Your distributors trust that their genealogy, their commissions, and their rank history will survive the transition. Break that trust and no amount of new features will recover it.

The processes in MLM software migration that we follow at FlawlessMLM:

- Financial baseline — Last three commission periods run through both engines. If results don’t match within 0.3% tolerance, we don’t proceed.

- Genealogy forensics — Every sponsor-upline relationship validated. Orphans, circular references, and duplicates flagged and resolved with client compliance.

- Dual-run validation — Both systems process live transactions for 2–4 weeks, catching edge cases synthetic data misses.

- Controlled cutover — Scheduled at lowest-activity window, never on payout day. Rollback SLA: full restoration within 4 hours.

This takes 6–10 weeks — faster than average because we’ve refined it across 90+ migrations. Companies that skip the dual-run phase pay for it in distributor support costs and attrition. Every time.

6 Expensive Mistakes We See in MLM Consulting Engagements

- Choosing a plan because competitors use it. Your compensation structure should match your product economics, not someone else’s distributor culture. Binary compensation plans work brilliantly for team-building urgency. They’re terrible for companies where 70%+ of revenue comes from retail customers. The best multi level marketing compensation plans are designed for your specific business, not copied.

- Treating MLM accounting software as an afterthought. When commission calculations and financial ledger entries aren’t synchronized in real time, month-end reconciliation becomes a 40-hour manual process. We’ve audited companies spending $8K/month on contractor hours just to reconcile their books.

- Hiring MLM consultants who can’t read code. Network marketing consulting has evolved. If your MLM consulting services provider can’t validate that the software implements the plan correctly at the database level, they’re advising blind. Our MLM consulting engineers audit the compensation engine alongside the business model — both layers matter.

- Running ecommerce MLM on a bolt-on cart. Separate ecommerce and commission systems create data lag, attribution gaps, and inventory sync failures. MLM skincare brands running Shopify alongside standalone MLM software lose an average of 22% autoship renewal rate versus natively integrated platforms.

- Migrating without a rollback plan. I can’t stress this enough. MLM software migration without tested rollback is gambling. We’ve only triggered rollback twice in 90+ migrations — but both times, having the procedure saved the client from a catastrophic launch failure.

- Ignoring genealogy effective dates during migration. A distributor who changed sponsors in 2021 needs that historical relationship preserved in the new system. Matrix MLM software and binary compensation plan software store tree history differently. Flattening history during migration corrupts retroactive reporting and audit trails.

What Competent MLM Consulting Actually Delivers

I use the word “competent” deliberately because the bar in this industry is low. A lot of what’s sold as MLM consulting is really just a slide deck and a contact list. What we deliver at FlawlessMLM — and what I’d expect from any MLM consulting company I’d hire — is measurably different:

- Payout simulation across 5K–200K distributor scenarios before plan finalization

- Commission engine stress-testing under 3× projected load

- Regulatory screening for target market compliance risks

- Full MLM software data migration roadmap with cost and risk assessment

- Ecommerce integration spec for product-first models

That’s the minimum scope for a serious engagement. MLM consulting services that don’t cover the technical layer alongside the business strategy are leaving money — your money — on the table.

The Question I Get Asked Most

Should I fix my current software or migrate to something new?

Fix if your plan structure is sound and the platform just needs optimization — better caching, query tuning, UI improvements. Migrate if the plan itself needs restructuring (matrix to hybrid, for instance) or if your software can’t support your compensation architecture without custom code for every change. In my project experience, the tipping point is usually around year three: that’s when the gap between what the business needs and what the platform can deliver becomes a revenue problem rather than an annoyance.

If you’re approaching that tipping point, a conversation with MLM consulting engineers who understand both the business and the code is worth more than another quarter of workarounds. We’ve spent twenty-two years building FlawlessMLM specifically for this moment — the moment where the right technology partner changes your trajectory.

— Ivan Shaulsky, Founder & CEO, FlawlessMLM

Frequently Asked Questions

How much money do MLM companies lose from wrong compensation plan software?

Based on FlawlessMLM audit data across 46 companies, the median annual loss is $340,000. Binary plans lose 9–16% of volume to flush-out. Forced matrix stalls enrollment. Disconnected ecommerce MLM programs lose 22% of autoship revenue to integration failures. What are the biggest hidden costs in MLM software migration?

Genealogy reconstruction when switching plan types ($15K–$40K), manual reconciliation during dual-run (80–120 staff hours), and distributor attrition from migration anxiety (6% average, reducible to under 3% with proper communication). Is unilevel or binary better for ecommerce MLM skincare brands?

Unilevel structures outperform pure binary for MLM skincare companies — unlimited width rewards broad retail bases. Adding a binary fast-start bonus creates recruitment urgency without losing retail depth. 73% of our beauty-vertical clients use this hybrid approach. When should I hire MLM compensation plan consultants?

When launching, migrating, entering regulated markets, or when payout ratios exceed 45% of revenue. Your consultants should design the plan math AND validate it inside the software engine. Can forced matrix MLM software convert to a hybrid without full migration?

Rarely. Matrix-to-hybrid requires MLM software data migration because genealogy structures are fundamentally different. A 5×7 matrix stores by position; binary stores by left/right leg. Converting in-place corrupts historical data. Proper migration with validation is the safe path.